Wise is known for its transparency in fees and pricing. Users can see exactly what they are paying for, with no hidden charges. In contrast, banks and other financial institutions, including PayPal, may not always be transparent about the fees embedded in their exchange rates. Both PayPal and Wise have their pros and cons. Let's review all of them and see which one is better for you as an international creator.

PayPal Pros & Cons

Pros

- Support payments to 200 countries, but you can only pay to another PayPal account

- Offer credit and pay later services to selected customers

- Instant money transfer between PayPal accounts

Cons

- High fees for business accounts

- Currency conversion includes a markup of 4%

PayPal is

perfect for eCommerce as you can easily integrate with your WordPress or Spotify website and

send funds among friends and families. Almost instant when sending payments between PayPal accounts. However, there are incur fees and delays when transferring money to a bank account.

Business should not use PayPal, particularly due to its less favorable currency exchange rates.

Wise Pros & Cons

Pros

- Low fees, based on payment method

- Send money to over 160 countries worldwide and supports holding and converting over 40 currencies

- Use mid-market exchange rates. Currency conversion starts from 0.43%

- Hold and manage 40+ currencies

- 31 USD one off fee to open a business account

Cons

- Transfer fees vary by destination country

- 50% of payments are instant, 90% arrive in 24 hours

As mentioned before, Wise is known to be more transparent in fees compared to PayPal. It has one-off fees to get started, but all the fees for every transaction is minimal. Wise is hands down the best option for international services for businesses, with a broader range of currencies supported, and use mid-market rate currency conversion when sending payments or spending overseas. Let's look at every aspect in detail on how you can save more with Wise.

Lower Fees for Currency Conversion

Wise charges lower fees than PayPal for currency conversion. PayPal adds a significant markup on top of the base exchange rate when converting currencies (e.g., CNY to USD, EUR, GBP, SGD), leading to higher costs for the sender. If you have a PayPal, check the currency calculator by going to Wallet and click Currency Calculator. For Wise, head to Currency Converter.

Save More with Mid-Market Exchange Rates

Wise uses the mid-market exchange rate for currency conversions. This is typically more favorable than the rates used by banks or PayPal, which often include hidden fees in their exchange rates. Let's use a simple example to illustrate why the mid-market rate is generally considered better for currency exchange. Imagine you are an American tourist planning to exchange USD for EUR for a trip to Europe. Let's say the current mid-market rate for USD to EUR is 1 USD = 0.90 EUR. This means, in the global currency market, 1 US Dollar is worth 0.90 Euros. If you exchange $1000, you would get 900 Euros (1000 x 0.90). With PayPal's 4% markup, 0.90 EUR is 0.036 EUR (4% of 0.90), so the rate becomes 0.90 - 0.036 = 0.864 EUR per USD. At PayPal's rate of 1 USD = 0.864 EUR, exchanging $1000 would give you 864 Euros (1000 x 0.864).

- Wise* with Mid-Market Rate: 900 Euros for $1000.

- PayPal Rate** with 4% Markup: 864 Euros for $1000.

*Do note that sometimes transfer fee can be higher in Wise per transaction but you still save more with Wise than using PayPal. Use their calculators to compare yourself.

**This is only assuming PayPal exchange rate is same as Wise, most often it is less than the mid-market exchange rate so the banks earn more.

More Supported Currencies

Despite PayPal claiming to offer 200 countries, you can only transfer between PayPal accounts. Wise allows users to send money to over 160 countries worldwide and supports holding and converting over 40 currencies. Borderless accounts allow users to receive money in various currencies, hold balances, and send money using local banks. This makes it highly accessible and convenient for international transfers.

Specific Services for China

For expats in China, Wise has made it possible to send money out of China, addressing a significant need. Users can transfer Chinese Yuan earnings to various countries, offering a solution that is not as readily available with PayPal in China. Wise supports sending money to Chinese UnionPay bank accounts, Alipay, and WeChat, which are widely used in China. According to Alipay 2023 research, Alipay has around 54% of the market share in China whereas WeChat Pay has 42% and UnionPay has only 4% of the market share. Note that WeChat Pay and Alipay check IP and you won't be able to use them after leaving China; you will require VPN, phone number in China and Chinese ID for money transfer. It gets less complicated if you use Wise. You can use WeChat Pay without linking a Chinese bank account, simply by adding credit card details. But there are some restrictions: WeChat Pay only accepts foreign credit cards, not debit cards. And you can only use WeChat Pay commercially in stores and not for sending money to friends and family. Transferring money from Wise to your bank account may take up to 2 days. Learn more how much you can transfer out of China per day on Wise's Transferring money in and out of China.

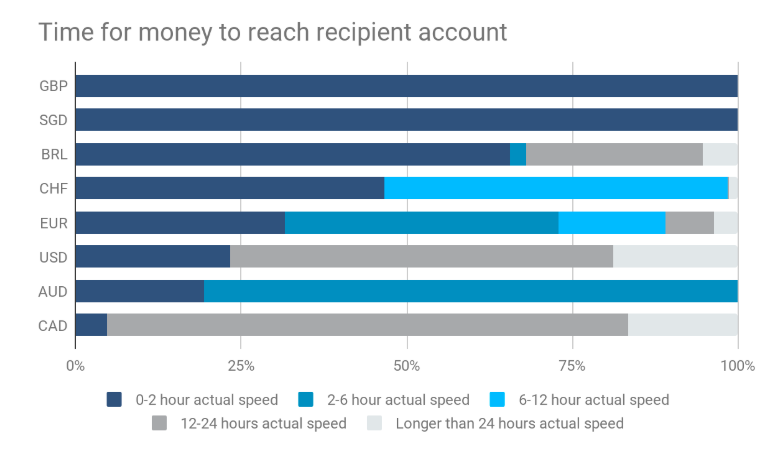

The Reason for Money Transfer Delays

Unlike PayPal which only allows transfer among PayPal accounts. Transfer times after payouts from Wise vary significantly across different countries with different currencies, primarily due to the structure of each country's payment system. In some nations, advanced systems enable near-instantaneous transfers (like the UK's FPS system), while in others, it can take several days. This delay is often due to the clearing cycles or 'cutoffs' of the payment systems, which are specific times each day (usually on working days) when banks exchange and settle payment information. These cycles determine when the funds are actually processed and reflected in the recipient's bank account, explaining the variation in transfer speeds from country to country. According to Wise, the best way to maximize the transfer speed is:

- Use Borderless balance

- Verify yourself

- Beware to send the fund before cutoff time or working hours of the country

Platforms with Wise

Out of 20 creative platform/ websites I researched, most reply on PayPal and only a few use Wise. Here is a small list of platforms that utilize Wise. Read our membership platform recommendations on how to choose which one you should use.

- Shopify

- Esty

- Unifans

- Pixiv

- Artfinder

Wise offers a more cost-effective, transparent, and user-friendly solution compared to PayPal, especially for international transfers from China. This makes it a preferred choice for many expats and creative individuals dealing with cross-border transactions.

立即注册 UniFans 引力圈, 轻松自由地创作吧!

立即注册 UniFans 引力圈, 轻松自由地创作吧!

nOTE:

Only team owners can access this feature. Please ask your team owner to access this feature.

RELATED CONTENT

UniFans Content Team

UniFans' content writing team is a group of creative storytellers dedicated to crafting engaging and insightful content for the digital world, specializing in topics that resonate with influencers and online content creators.