Uncertain about which subscription based platform to choose? We've developed a PayPal fee calculator to help creators understand how much income they can earn through each subscription-based platform.

Key takeaways:

- If you not a US citizen, you have to pay a lot to platforms and PayPal due to international transaction fees.

- Unifans uses Wise as payment processer, which has the best currency exchange rates and lowest fees, making it the best subscription-based platform for European and Asian countries.

A Calculator for Creators

Total fees charged: 0.00

Net profit: 0.00

Net profit in USD: $0.00

Last updated on February 28, 2024.

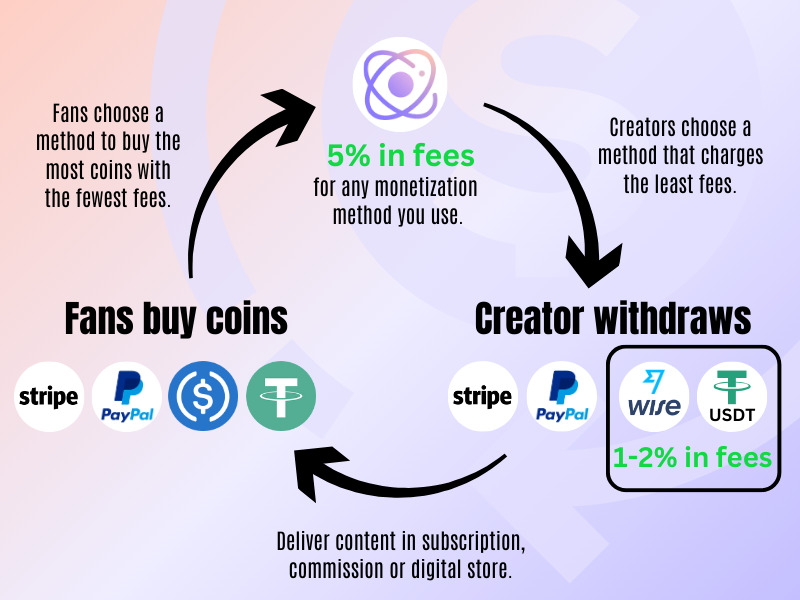

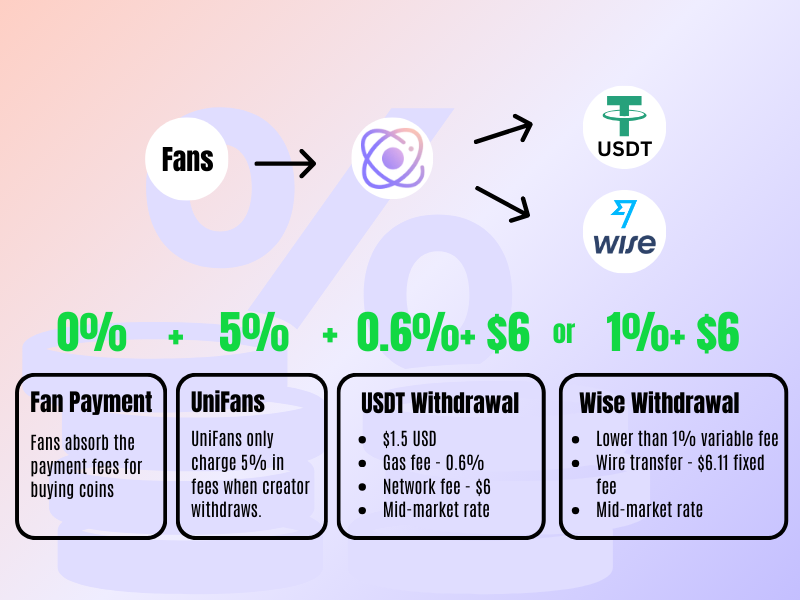

In comparison to Patreon and other platforms, we use a coin system and alternative withdrawal methods, Wise and USDT, which charge less fees for international transactions.

Subscription-based Platform Fees

| Platforms | Base fee | Processing | Receive | Deposit |

|---|---|---|---|---|

| Patreon | 8 to 12% | 2.9%+$0.3 | 2.99%* | 2.9%* |

| Unifans | 5% | 0 | 0 | 4.22+1.14%** |

| Ko-fi | 5% | 0 | 2.99%* | 2.9%* |

| Gumroad | 10% | 2.9%+$0.3 | 2.99%* | 2.9%* |

| Buy me a coffee | 5% | 2.9%+$0.3 | 2.99%* | 2.9%* |

| Fantic | 10% | 2.9%+$0.3 | 4.49%* | 2.9%* |

| Platforms | Currency Conversion Fee | Exchange Rate |

|---|---|---|

| Patreon | 3%* | n/a |

| Unifans | 1.1%** | n/a |

| Ko-fi | 3%* | n/a |

| Gumroad | 3%* | n/a |

| Buy me a coffee | 3%* | n/a |

| Fantic | 3%* | 0.0066 |

Last updated on February 28, 2024.

*fees charged by PayPal

**fees charged by Wise

Processing Fee

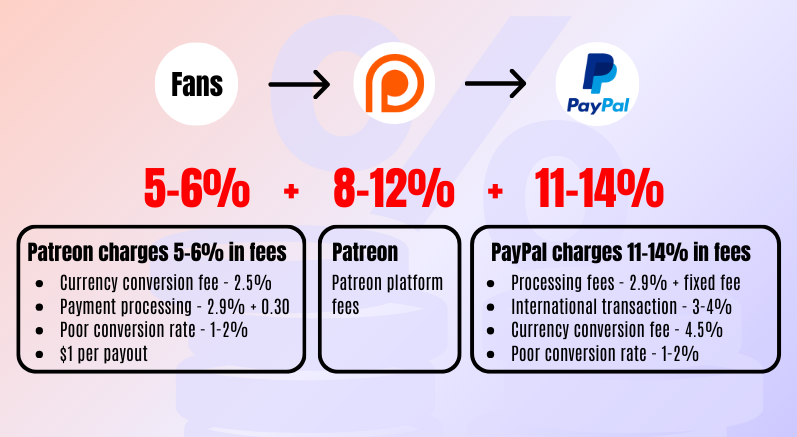

Processing fee is charged by the platform, meaning the platform charges an additional fee for every transaction. Lets take an example, you have 100 paid subscriptions and each pays you $5 on Patreon.

Expectation:

100 x 5 = $500

With processing fee ( 2.9%+$0.3 ):

$5 x 2.9% + $0.3 = $0.45

$5 - $0.445 = $4.55

100 x $4.55 = $455

*2.5% currency conversion not included

Patreon platform fee ( 8-12% )

$455 x ( 1- 12% ) = $400.4

You may think you are receiving $500, but in fact, you are only receiving $400 in total; you lost 20% of your revenue due to Patreon fees. As far as my research goes, currently, only Patreon and Buy Me a Coffee charge creators extra for every transaction. However, Buy Me a Coffee offers the option to let your fans pay the 2.9% + 0.3 fee instead of you. There is no alternative option other than migrating to another subscription platform. You may think donations may be an exemption, but they are still considered goods and services. If you are a US citizen, it is still taxable as self-employment income.

Do note that Patreon charges an additional 2.5% to the

currency conversion fee if fans purchase with currency other than USD. Likewise, all platform charges it through either PayPal or Stripe. Unifans uses a virtual currency ( 10 coin = 1 USD ) that allows fans to purchase coins at local stores and whatever way is convenient for them.

PayPal Fees for Receiving

When you receive your money from a subscription platform to PayPal, PayPal charges you a receiving money fee. The payment type is Send/Receive Money for Goods and Services and you are charged 2.99% for every transaction. If you are using an international platform like Fantia, then you have to pay an extra 1.5% for international commercial transactions; thus, 4.49% for every transaction. In comparison, Unifans, which uses Wise, charges a flat fee of $4.14 for every transaction to Wise wallet.

Conversion Fee and Rate

For those who need to convert your earnings from USD to other currencies, PayPal charges 3% with a lower exchange rate compared to the one you search on Google. That is because PayPal and banks typically offer exchange rates about 1% lower than the mid-market rate and earn profit from the difference. I would advise you to transfer your money to Payoneer then you convert your desired currency; however, that would also incur additional fees.

The only platform that offers an alternative solution is Unifans, which utilizes Wise for currency conversion. Compared to PayPal, Wise typically provides more transparency and lower fees, especially for international transfers. They transfer funds based on the mid-market exchange rate and charge a small fixed fee. This is the best platform if you are not a US citizen. To learn more about Wise's low fees and exchange rate, check Wise's currency calculator. For Chinese creators, using Wise means you don't have to pay USD $35 for every withdrawal from PayPal. Check out our Platform and Fee Calculator for Chinese creators.

Withdrawing from PayPal

To withdraw funds from a PayPal business account, you have two main options: standard withdrawals to a linked bank account or eligible cards, or instant withdrawals with applicable fees. Standard withdrawals to a linked bank account are free when no currency conversion is involved, but there may be fees associated with instant withdrawals, which amount to 1.50% of the transferred amount. Withdrawal limits apply to instant withdrawals. Similarly, withdrawals to eligible linked debit cards are free when no currency conversion is involved for both standard and instant withdrawals. However, a 1.50% fee is applied to instant withdrawals, with withdrawal limits also in place. Additionally, there may be minimum fees based on the currency of the withdrawal.

立即注册 UniFans 引力圈, 轻松自由地创作吧!

立即注册 UniFans 引力圈, 轻松自由地创作吧!

nOTE:

Only team owners can access this feature. Please ask your team owner to access this feature.

RELATED CONTENT

UniFans Content Team

UniFans' content writing team is a group of creative storytellers dedicated to crafting engaging and insightful content for the digital world, specializing in topics that resonate with influencers and online content creators.